As a small business owner, managing payroll can be a complex and time-consuming task.

From calculating wages and deductions to staying compliant with tax regulations, the payroll process involves a lot of manual work that leaves room for error.

Fortunately, payroll software offers a solution that can simplify and streamline these tasks, making payroll processing more efficient and less stressful for you and your team.

Payroll software has become increasingly popular among small businesses because it automates many of the repetitive tasks associated with payroll management, reduces the risk of errors, and ensures compliance with ever-changing tax laws.

In this blog post, we’ll explore the key benefits of using payroll software for small businesses, demonstrating how it can help you save time, reduce costs, and enhance overall business operations.

Payroll Software for Small Businesses: Benefits

1. Time Savings and Efficiency

One of the most significant advantages of payroll software for small businesses is the time savings it offers. Traditional payroll processing involves manual calculations for wages, deductions, and tax withholdings, which can be tedious and time-consuming.

Payroll software for small businesses automates these processes, drastically reducing the time you spend on payroll management.

- Automated calculations: Payroll software automatically calculates salaries, overtime, deductions, and taxes, minimizing the need for manual data entry. This not only saves time but also reduces the likelihood of human error.

- Streamlined processes: With payroll software, tasks that once took hours can be completed in minutes. This efficiency frees up valuable time for you and your HR staff to focus on strategic activities that drive growth, such as employee development and business planning.

- Reduced administrative burden: By automating repetitive tasks, the software significantly reduces your administrative workload, allowing you and your team to concentrate on core business functions.

Overall, the time savings and increased efficiency provided by payroll software enable small businesses like yours to operate more smoothly and effectively.

2. Cost-Effectiveness

Cost is a crucial consideration for any small business, and payroll software can offer significant savings compared to traditional payroll processing methods.

- Lower operational costs: By reducing the need for paper, printing, and storage of payroll records, payroll software helps cut down on operational costs. Additionally, many payroll software solutions are cloud-based, offering subscription pricing models that are more affordable than maintaining in-house payroll teams or hiring external payroll services.

- Minimized errors and fines: Payroll errors can be costly, leading to penalties and fines from tax authorities. Payroll software reduces the risk of errors by automating calculations and ensuring compliance with tax laws, potentially saving you thousands of dollars in fines and penalties.

- Affordable for small businesses: Cloud-based payroll systems for small businesses offer flexible pricing plans that can scale with the size and needs of your business. This makes payroll software accessible even if you have a limited budget, providing you with advanced tools without a hefty upfront investment.

By reducing costs associated with payroll management and minimizing the risk of costly errors, payroll software proves to be a cost-effective solution for your small business.

3. Improved Accuracy and Compliance

Ensuring accurate payroll processing and compliance with tax regulations is critical for your business. Payroll software helps you maintain accuracy and stay compliant with local, state, and federal laws.

- Accurate calculations: Payroll software automatically calculates employee wages, taxes, and deductions, significantly reducing the risk of errors that can occur with manual calculations. Accurate payroll processing ensures that employees are paid correctly and on time, improving overall satisfaction and trust.

- Compliance with tax laws: Tax laws and regulations frequently change, and keeping up with these changes can be challenging. Payroll software provides automatic updates for tax rates and regulations, helping you stay compliant and avoid costly penalties.

- Built-in compliance checks: Many payroll software solutions include built-in compliance checks that ensure all payroll processes align with current laws and regulations. This feature provides peace of mind, knowing that your payroll is compliant and up-to-date.

With payroll software, you can ensure accurate payroll processing and stay compliant with tax laws, reducing the risk of costly errors and penalties.

4. Enhanced Security and Data Privacy

Handling sensitive employee information, such as Social Security numbers, bank account details, and salary information, requires a high level of security. Payroll software provides robust security features to protect this data.

- Data encryption: Payroll software uses encryption to protect sensitive data both in transit and at rest, ensuring that employee information is secure from unauthorized access.

- User access controls: Payroll software allows you to set user access controls, limiting who can view and edit payroll information. This helps prevent unauthorized access and reduces the risk of internal fraud.

- Secure cloud storage: Many payroll software solutions are cloud-based, offering secure storage for payroll data. This eliminates the need for physical storage of sensitive documents, reducing the risk of data breaches and loss due to theft or disasters.

By enhancing security and protecting sensitive employee information, payroll software helps you build trust with your employees and avoid potential legal issues related to data breaches.

5. Easier Record-Keeping And Reporting

Effective record-keeping and reporting are essential for payroll management, and payroll software makes these tasks much easier.

- Organized data storage: Payroll software helps you organize and store payroll data efficiently, making it easy to access and retrieve information when needed. This is especially useful for audits, tax filings, and employee inquiries.

- Customizable reports: Payroll software offers customizable reporting features, allowing you to generate detailed reports on various payroll metrics, such as total wages, overtime, and tax withholdings. These reports can be tailored to meet your specific needs.

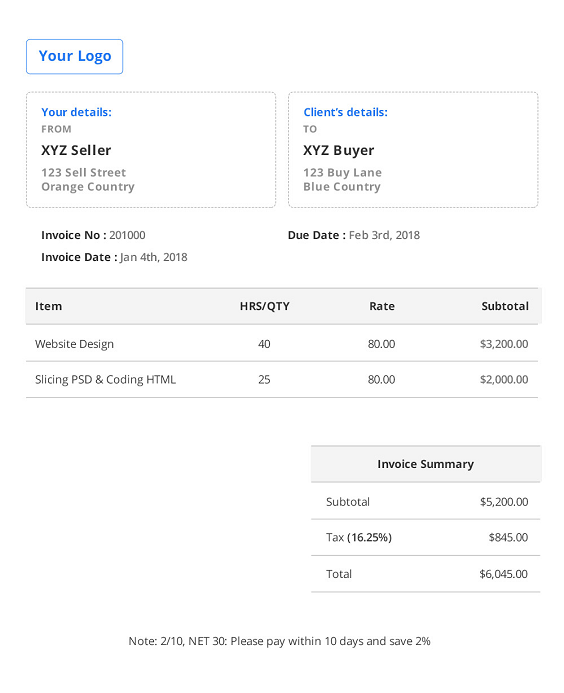

- Integration with accounting software: Many payroll software solutions integrate seamlessly with accounting software, streamlining financial reporting and ensuring consistency across all financial documents.

With payroll software, you can maintain accurate records and generate reports quickly and easily, simplifying the payroll management process.

6. Employee Self-Service Options

Payroll software often includes employee self-service portals, which provide significant benefits for both you and your employees.

- Access to information: Employee self-service portals allow employees to view their pay stubs, manage personal information, and access tax documents without having to go through HR. This reduces the administrative burden on HR staff and provides employees with quick and easy access to their information.

- Improved employee satisfaction: By giving employees greater control over their payroll information, self-service portals help improve employee satisfaction and engagement.

- Reduced administrative workload: Employee self-service options reduce the number of inquiries HR staff need to handle, freeing up time for more strategic tasks.

Employee self-service options provided by payroll software not only enhance employee satisfaction but also help reduce your administrative workload.

7. Scalability And Flexibility

As your small business grows, your payroll needs can become more complex. Payroll software like Tieghtsuite offers the scalability and flexibility needed to adapt to these changing needs.

- Scalable solutions: Payroll software can easily scale with a growing business, accommodating additional employees, pay structures, and compensation models as needed. This scalability ensures that the software remains effective and efficient, even as your business grows.

- Flexible payroll processing: Payroll software can handle various pay structures, such as hourly wages, salaries, commissions, and bonuses, making it a versatile tool for businesses with diverse payroll needs.

- Customizable features: Many payroll software solutions offer customizable features that can be tailored to meet the specific needs of your business, providing flexibility and ensuring the software continues to support your business as it evolves.

The scalability and flexibility of payroll software make it an ideal solution for your small business as it grows and adapts to changing payroll needs.

8. Streamlined Integration With Other Systems

Integrating payroll software with other business systems, such as accounting, time tracking, and HR software, can greatly enhance efficiency and accuracy.

- Seamless data synchronization: Payroll software can integrate with other systems to synchronize data automatically, reducing the need for manual data entry and minimizing the risk of errors.

- Improved workflow efficiency: Integration with other systems helps streamline workflows, enabling you to manage payroll, accounting, and HR tasks more efficiently.

- Centralized data management: With integrated systems, you can manage all your payroll and HR data from a single platform, simplifying data management and improving overall efficiency.

By integrating payroll software with other business systems, you can streamline your workflows and improve data accuracy, enhancing overall business efficiency.

9. Support And Updates From Software Providers

One of the often-overlooked benefits of payroll software is the support and regular updates provided by software vendors.

- Ongoing customer support: Payroll software providers typically offer customer support to help you troubleshoot issues and maximize the use of the software. This support can include phone, email, or chat support, as well as online resources like tutorials and FAQs.

- Training resources: Many payroll software solutions come with training resources that help you onboard new users and ensure that everyone understands how to use the software effectively.

- Regular software updates: Payroll software providers regularly update their software to incorporate new features, improve security, and ensure compliance with the latest tax laws and regulations. These updates help you stay current and compliant, reducing the risk of errors and penalties.

The support and updates provided by payroll software vendors ensure that you can continue to use the software effectively and remain compliant with changing regulations.

If you’re a small business owner looking to simplify your payroll process, consider exploring different payroll software options to find the best fit for your needs. Investing in the right payroll software for small businesses can not only make payroll management easier but also contribute to the overall success of your business.

Tieghtsuite Offers the Best Payroll Software for Small Businesses

Ready to optimize your payroll management? Sign up for Tieghtsuite today to access free payroll software for small businesses and experience the difference it can make !

Get started now for free and see how easy managing payroll can be.